What is Schedule M-3 for?

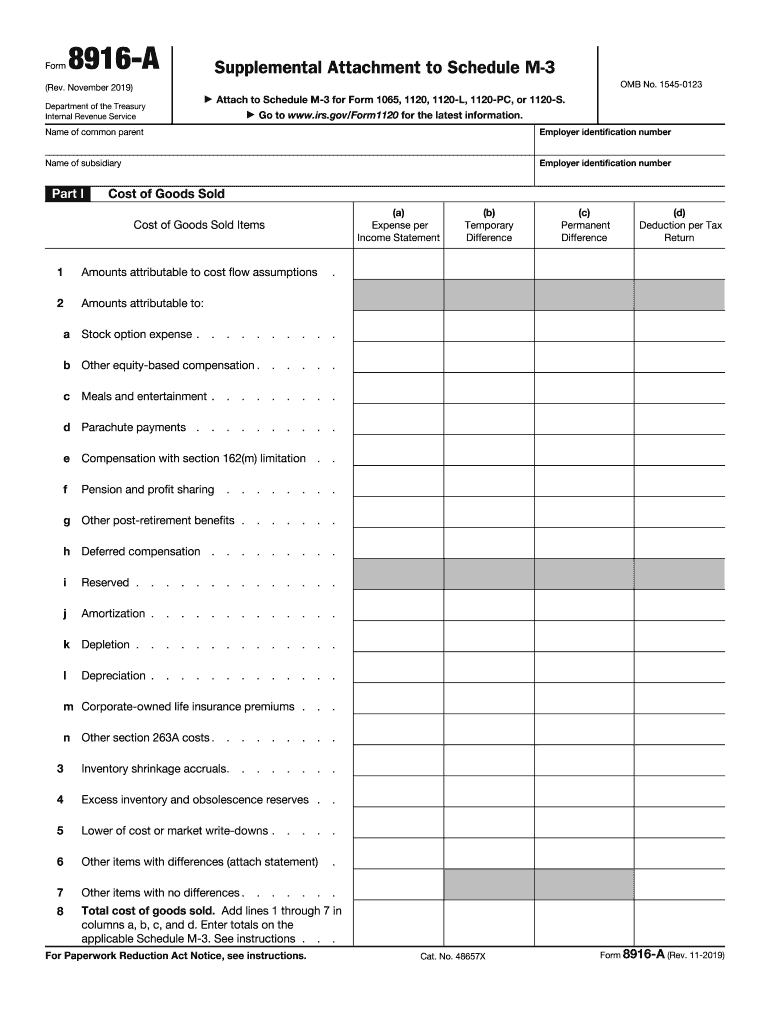

The Schedule M-3 gives the IRS additional information about tax-return calculations and the differences between book income numbers and taxable income numbers. The Schedule M-3 contains three main sections: Financial statement reconciliation (Part I) Detail of income/loss items (Part II)

Who needs to file Schedule M-3?

Any entity that files Form 1065 must file Schedule M-3 (Form 1065) if any of the following is true. The amount of total assets at the end of the tax year reported on Schedule L, line 14, column (d), is equal to $10 million or more. The amount of adjusted total assets for the tax year is equal to $10 million or more.

What is the purpose of Schedule M-3 of 1065?

Any entity that files Form 1065 must file Schedule M-3 (Form 1065) if any of the following is true: The amount of total assets at the end of the tax year reported on Schedule L, line 14, column (d), is equal to $10 million or more. The amount of adjusted total assets for the tax year is equal to $10 million or more.

Who is required to file a Schedule M-3?

corporations required to file Form 1120, U.S. Corporation Income Tax Return, that reports on Form 1120, Schedule L, Balance Sheets per Books, total assets at the end of the corporation's tax year that equal or exceed $10 million must file Schedule M-3 instead of Schedule M-1, Reconciliation of Income (Loss) per Books

What is the purpose of Schedule M-3?

The Schedule M-3 gives the IRS additional information about tax-return calculations and the differences between book income numbers and taxable income numbers. The Schedule M-3 contains three main sections: Financial statement reconciliation (Part I) Detail of income/loss items (Part II)

What is Schedule M-3 tax?

Schedule M-3, Part I, asks certain questions about the partnership's financial statements and reconciles financial statement net income (loss) for the consolidated financial statement group to income (loss) per the income statement for the partnership.

What is a schedule m-3 for Form 1120?

Schedule M-3, Part I, asks certain questions about the corporation's financial statements and reconciles financial statement net income (loss) for the corporation (or consolidated financial statement group, if applicable), as reported on Part I, line 4a, to net income (loss) of the corporation for U.S. taxable income

Is Schedule M-3 required?

Schedule M-3 is required in lieu of Schedule M-1 for corporate filers that report on Schedule L total assets at the end of the tax year equal to or exceeding $10 million. Corporations filing Schedule M-3 must not file Schedule M-1. A corporation that is not required to file Schedule M-3 can file it voluntarily.

Who must file Schedule M-3 1120s?

Any corporation required to file Form 1120-S U.S. Income Tax Return for an S Corporation that reports on Schedule L of Form 1120-S total assets at the end of the corporation's tax year that exceed $10 million must complete and file Schedule M-3 (Form 1120-S) Net Income (Loss) Reconciliation for S Corporations With

What is the difference between Schedule m1 and m3?

The Schedule M-1 must be prepared by corporations with total receipts or total assets of $250,000 or more. The Schedule M-3 must be prepared by corporations reporting gross assets of $10 million or more in assets on Schedule L of Form 1120.

How does Schedule M-3 work?

The Schedule M-3 gives the IRS additional information about tax-return calculations and the differences between book income numbers and taxable income numbers. The Schedule M-3 contains three main sections: Financial statement reconciliation (Part I) Detail of income/loss items (Part II)

Who must file Schedule M-3 1065?

Any entity that files Form 1065 must file Schedule M-3 (Form 1065) if any of the following is true: The amount of total assets at the end of the tax year reported on Schedule L, line 14, column (d), is equal to $10 million or more. The amount of adjusted total assets for the tax year is equal to $10 million or more.

What is the purpose of Schedule M-3 of form 1065?

Schedule M-3 is required when the partner's total assets or adjusted total assets at the end of the tax year is equal to $10 million or more, or the partnership's total receipts for the tax year is $35 million or more. The calculation for Schedule M-3 is done in reverse from the form itself.

Who is required to file M-3 1120?

Schedule M-3 is required in lieu of Schedule M-1 for corporate filers that report on Schedule L total assets at the end of the tax year equal to or exceeding $10 million.

Who must use Schedule M-3?

corporations required to file Form 1120, U.S. Corporation Income Tax Return, that reports on Form 1120, Schedule L, Balance Sheets per Books, total assets at the end of the corporation's tax year that equal or exceed $10 million must file Schedule M-3 instead of Schedule M-1, Reconciliation of Income (Loss) per Books

What is IRS Schedule M-3?

This Schedule M-3 is being filed because (check all that apply): A The amount of the partnership's total assets at the end of the tax year is equal to $10 million or more. B The amount of the partnership's adjusted total assets for the tax year is equal to $10 million or more.

Who is required to file a Schedule M-3?

Any entity that files Form 1065 must file Schedule M-3 (Form 1065) if any of the following are true: amount of total assets at the end of the tax year reported on Schedule L, line 14, column (d), is equal to $10 million or more. amount of adjusted total assets for the tax year is equal to $10 million or more.

Who is required to file M-3?

Schedule M-3 is required in lieu of Schedule M-1 for corporate filers that report on Schedule L total assets at the end of the tax year equal to or exceeding $10 million.