IRS 8916-A 2019-2025 free printable template

Show details

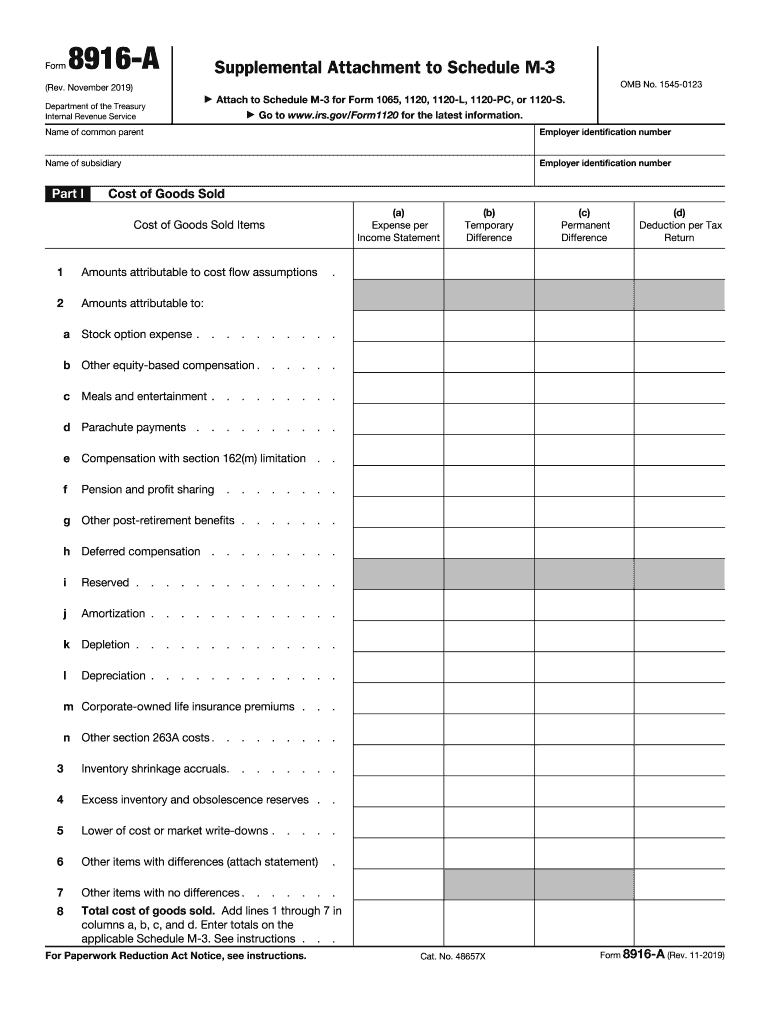

Form8916ASupplemental Attachment to Schedule M3 OMB No. 15450123(Rev. November 2019) Department of the Treasury Internal Revenue ServiceAttach to Schedule M3 for Form 1065, 1120, 1120L, 1120PC, or

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 8916-A

Guidelines for Efficiently Editing IRS 8916-A

Instructions for Filling Out IRS Form 8916-A

Understanding and Utilizing IRS Form 8916-A

IRS Form 8916-A plays a pivotal role in the tax preparation process, particularly for those involved in certain transactions and financial activities. It is crucial to grasp its implications, how to fill it out correctly, and the most recent updates that might affect your tax obligations. This comprehensive guide will help you navigate the details of IRS 8916-A, ensuring you are well-informed and ready to comply with tax regulations.

Guidelines for Efficiently Editing IRS 8916-A

Editing IRS Form 8916-A requires careful attention to detail. Here are the steps to follow:

01

Review the form for accuracy—verify all numerical figures against original documents.

02

Ensure all necessary supporting documents are attached, including transaction details and any relevant proof.

03

Check for completion—make sure every section is filled out as required to avoid delays.

04

Seek assistance if needed—consider consulting a tax professional for complex entries.

05

Submit the completed form in a timely manner to ensure compliance with IRS regulations.

Instructions for Filling Out IRS Form 8916-A

Completing IRS Form 8916-A involves several straightforward steps:

01

Gather relevant documentation, such as transaction records and income statements.

02

Begin filling out the form, entering your name, tax identification number, and address.

03

Provide details about transactions covered under the relevant sections, ensuring clarity and accuracy.

04

Double-check all entries for typographical errors or omissions.

05

Sign and date the form upon completion to certify its accuracy.

Show more

Show less

Recent Developments Regarding IRS Form 8916-A

Recent Developments Regarding IRS Form 8916-A

It is essential to stay updated on changes to IRS Form 8916-A to ensure compliance and avoid penalties. Recently, the IRS introduced specific adjustments:

01

New thresholds for income reporting have been established, impacting who must file.

02

Procedural changes have been made regarding electronic submission, streamlining the filing process.

03

Clarifications have been issued about qualified exemptions that now include certain income categories.

Essential Information Regarding the Purpose and Application of IRS Form 8916-A

Defining IRS Form 8916-A

Understanding the Purpose of IRS Form 8916-A

Who Needs to Complete IRS Form 8916-A?

Conditions for Exemptions From Filing IRS Form 8916-A

Core Components of IRS Form 8916-A

Filing Deadline for IRS Form 8916-A

Comparing IRS Form 8916-A With Similar Reporting Forms

Transactions Covered by IRS Form 8916-A

Required Copies for Submission of IRS Form 8916-A

Penalties for Non-Compliance With IRS Form 8916-A Submission

Information Needed for Filing IRS Form 8916-A

Supplementary Forms Accompanying IRS Form 8916-A

Where to Submit IRS Form 8916-A

Essential Information Regarding the Purpose and Application of IRS Form 8916-A

Defining IRS Form 8916-A

IRS Form 8916-A is a tax form used for reporting specific transactions that may impact tax obligations, particularly for corporations and partnerships. Understanding the form's context is vital for accurate tax filing.

Understanding the Purpose of IRS Form 8916-A

The primary purpose of IRS Form 8916-A is to ensure that taxpayers report certain transactions accurately, thus maintaining transparency with the IRS. The form plays a significant role in identifying the nature of these transactions and their implications on taxable income.

Who Needs to Complete IRS Form 8916-A?

This form is typically required for corporations or partnerships engaged in transactions that meet specific criteria, such as large-scale investments or mergers. Taxpayers should evaluate their financial activities to determine if filing is necessary.

Conditions for Exemptions From Filing IRS Form 8916-A

Exemptions from filing IRS Form 8916-A may apply under certain conditions, including:

01

Annual gross income below $200,000 for businesses.

02

Transactions involving assets valued under $10,000.

03

Entities engaged solely in charitable activities.

04

Specific industry exemptions, such as agricultural businesses reporting under different thresholds.

For instance, a small farming operation with an annual income of $150,000 may qualify for an exemption, negating the need to file the form.

Core Components of IRS Form 8916-A

The key sections of IRS Form 8916-A include:

01

Taxpayer identification information.

02

Details of transactions being reported.

03

Supporting documentation and disclosures of potential taxable events.

Filing Deadline for IRS Form 8916-A

The deadline for submitting IRS Form 8916-A aligns with the annual federal tax return deadlines, typically April 15 of each year. For corporations, the deadline is often the 15th day of the fourth month following the close of the tax year, or similar extensions if filed appropriately.

Comparing IRS Form 8916-A With Similar Reporting Forms

IRS Form 8916-A is akin to forms like 1120 and 1065, which also report income for business entities. However, while Form 1120 is specifically for C Corporations, and Form 1065 is for partnerships, Form 8916-A focuses on specific transaction-related disclosures unique to certain tax scenarios.

Transactions Covered by IRS Form 8916-A

This form may cover various transactions, including:

01

Mergers between corporations.

02

Sale or exchange of significant assets.

03

Activities involving the transfer of stock ownership in large volume.

Required Copies for Submission of IRS Form 8916-A

Typically, one copy of IRS Form 8916-A is submitted with your tax return, unless stated otherwise by the IRS guidelines or indicated for specific circumstances.

Penalties for Non-Compliance With IRS Form 8916-A Submission

The implications of failing to submit IRS Form 8916-A can be substantial, with penalties that may include:

01

Failure to file penalties, starting at $100 per month.

02

Potential criminal charges for willful neglect, leading to fines or imprisonment.

03

Increased scrutiny from the IRS, resulting in further audits or reviews.

Information Needed for Filing IRS Form 8916-A

When preparing to file IRS Form 8916-A, gather the following information:

01

Taxpayer identification number.

02

Details of the transactions being reported, including dates and amounts.

03

Supporting documentation evidencing the transactions.

Supplementary Forms Accompanying IRS Form 8916-A

If applicable, forms such as Schedule K-1 may need to accompany IRS Form 8916-A, particularly in cases involving partnerships where income distribution impacts are considered.

Where to Submit IRS Form 8916-A

IRS Form 8916-A should be submitted to the address indicated in the instructions on the form relevant to your specific tax situations, such as your principal business location or the designated IRS center for corporate filings.

By understanding and applying the information about IRS Form 8916-A, you can effectively navigate the complexities of tax compliance. If you’re unsure about the process, consider reaching out to a tax professional for assistance or utilize resources like pdfFiller to simplify your filing experience.

Show more

Show less

Try Risk Free